Should I Invest if I Have Debt?

Ahh the age old question: should you invest if you have debt?

Before we dive into the answer to that question, let me say, if you have debt (and chances are you do if you’re reading this post), leave any shame you may feel at the door. This is a safe space!

The truth is, the average American has about $96,000 in debt. There’s such shame and stigma surrounding being in debt, and I want you to know that you’re not alone, and you have so many options for how to invest your money, plan for the future, and build wealth, even with debt.

Okay, so back to your question: Amanda, should I invest if I have debt?

There’s the math answer and there’s the emotional answer.

And while we typically want to leave out emotions when it comes to investing, money stuff can be emotional! Debt in and of itself especially is very emotional and not always a math equation. This is why we hear about celebrities like Tiffany Haddish, who were homeless at one point, buying their homes in cash when they become rich (they want to know they OWN it). She never wants to risk not having a home. She wants to own it outright due to this experience. Even if that doesn’t make the most mathematical sense due to the low interest rate that come along with a mortgage, it makes sense for her. Remember, money is mental AF!

So let’s look at both scenarios to see which best fits your needs for right now.

When you should invest while in debt

Mathematically speaking, you should invest even while in debt if the interest rate of your debt is low. The general rule of thumb is if a debt is 7% or under, it makes more sense to invest vs aggressively paying down the debt.

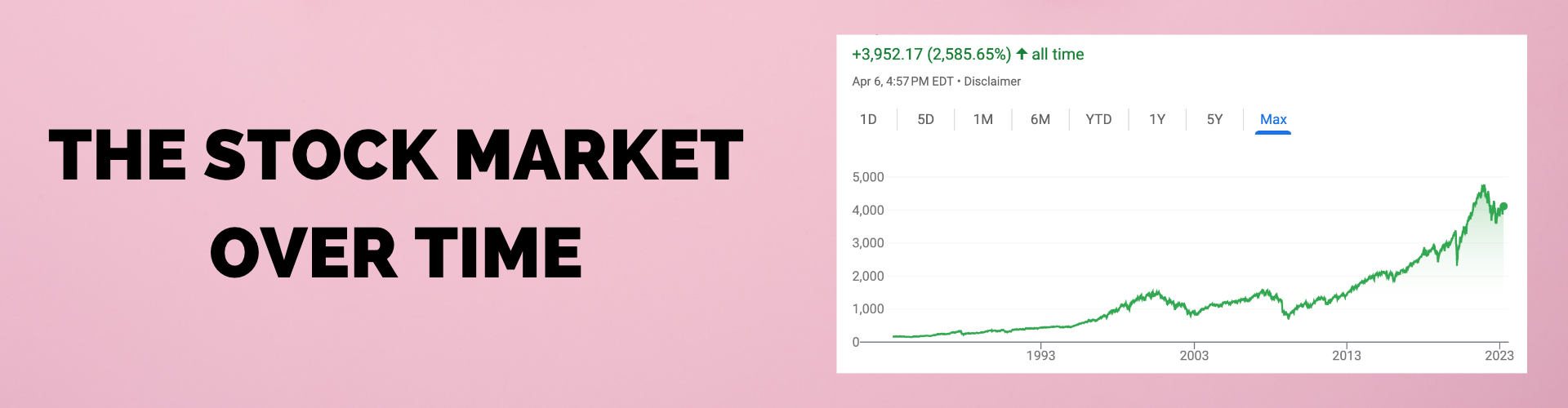

Why? Because the stock market averages a return of 8% over time, after inflation. Not EACH individual year, but an average over time.

When we consider that the average student loan interest rate as of 2023 is 5.8% and the average interest rate for a 30-year mortgage in 2023 is 6.98%, chances are that a lot of the debt you’re paying off each month will have rates lower than the 8% rule of thumb.

If you’re younger and just starting out, you might have student loan debt, a newer mortgage, a car payment, and are maybe still paying off that time you put the girls trip to Cancun on a credit card because you got major FOMO (whoopsies). While you may have more debt earlier in your financial journey, and your knee jerk reaction may be HOLY MOLY! I NEED TO PAY OFF THIS DEBT AND I NEED TO PAY IT OFF LIKE YESTERDAY, you also have the benefit of time to earn compound interest on your investments.

The stock market can be fickle, but when we look at the historical inflation rates and the average performance of the market, mathematically, it makes sense to invest your money when you have a low interest rate on your debt rather than throw it all at your debt. Doing so will help you be free of that debt by the time you retire and have enough money to actually reach financial freedom!

When you might choose to pay off debt before investing

There are times when it may make sense to choose to pay off debt before investing.

If you’re swimming in credit card debt, for example, it wouldn’t be wise to pay only minimums and invest heavily (Yes, it’s time we prioritize paying off that vacation you put on your credit card now). The average credit card interest rate at the time of writing this post is around 24%. At that rate, our bestie, compound interest, ends up working backwards causing us to owe more in interest than we’d earn in interest on our investments.

You may also want to pay down debt more aggressively before you invest if your monthly minimum payments are eating up a large portion of your budget and keeping you from staying current on all of your bills. Getting that total amount owed down to a more manageable number will not only help your monthly budget, but it will improve your credit score, relieve stress, and give you more wiggle room with how much you can invest each month. Please watch out for those big debts that are tough to get out of and tend to eat up large portions of peoples’ budgets: IE don’t go getting a mortgage before you’re ready, a fancier car than you can afford, etc.

Finally, you might decide paying off debt before investing makes sense for you is that emotional component of money I talked about earlier.

As much as we don’t want it to, money elicits a strong emotional response. There’s shame for having debt in the first place, the fear of running out of money, the fear of staying in debt forever, the stress that comes from the lack of financial independence, and the list goes on and on.

So if investing a little into the Roth IRA or just getting your employer match makes you FEEL better and less behind WHILE you throw all extra money at the debt —even if it’s low interest, who am I to say that’s not ok?

Whatever gets you over the finish line is what you should do!

How to Invest Even When You Have Debt

There is some great news: It is possible to invest even when you have debt! And doing both is easier than you may think!

One of the first things you can do is make sure you have the 5 accounts everyone should have. Some of these accounts are to help you manage your money today like multiple checking accounts to help you manage your cash flow and monthly bills, and savings accounts with “buckets” like an emergency fund, a sinking fund to keep all of your short term savings organized. Keeping things organized is key!

And if you’re ready to finally take that step to investing, come to my free investing party! I’ll teach you how to buy a stock with literally $1 (seriously, you can start investing with as little as $1!) and how to stop the money anxiety from keeping you up at night. You can do this friend! Set aside 60 mins and show up for you!