How to Plan for a Debt-Free Holiday Season

It’s time to start planning for the holidays!

Ummmm…Amanda, it’s July…

I know. But 42% of Americans go into debt for the holidays. That’s not going to be us. This year, we’re getting ahead of things.

I am not by any means wishing summer away, but we’re already halfway through the year. We need to start understanding what’s going in, what’s going out and what opportunities we have NOW before all the exciting, fun holiday things come up!

Debt=stress. Stress≠holiday joy.

You deserve to have a joyful holiday season that won’t leave you saying WTF have I done!? when that credit card statement arrives in January.

How to Have a Debt Free-Holiday Season

So how do we have a debt-free holiday season? Start with these steps:

Start by knowing how much you need

People spend an average of $1,800 for Christmas and Thanksgiving!

But this is just the average. Of course, some of us are going to spend much more or much less. The amount doesn’t really matter, but knowing how much we plan to spend does.

Go back to see how much YOU actually spent last year (yes, go back, go through your bank statements, and actually total it up). Think about what it will look like this year.

Are you going on a trip? Are you hosting Thanksgiving this year? Buying new decorations? Hosting a White Elephant party? Are you foregoing gifts altogether?

Make a list of everyone you have to buy for this year and allocate a dollar amount to spend on each person. Don’t forget to include those people we shop for but often forget about until the holiday season rolls around like teachers, secretaries, postal carriers, dog groomers, etc.

Whatever your plans for holiday spending are this year, come up with realistic figures for you.

Do this exercise first, see what you had to work with, and then move on to that next step of budgeting out for those holiday events.

Set up a holiday budget and stick with it

Now that you know how much you need to save, figure out how much you need to set aside each paycheck to hit that dollar amount.

If we use the average American holiday spending figure, we’d divide $1,800 by 5. We’d need to save $360 each month, or $180 each paycheck in order to hit this goal.

That’s $360 in July, August, September, October, and November. We don’t count December because we need to actually have the money to spend by then.

One benefit of planning for Christmas spending even earlier in the year is being able to spread out our savings throughout the whole year putting aside less money each check. Remember to add a sinking fund for the holidays when you sit down to redo your budget!

I am not the person who neurotically spends a bunch of time in a spreadsheet each month. I have my budget set up so that it works on autopilot. So if you’re worried this is going to be some big time-consuming chore each month that you don’t have time for, let’s get out of that mindset now.

And of course, stick with your budget! You work too hard to constantly be clawing your way out of credit card debt. Find your target, save your dollars, and don’t dip into your Christmas savings every other week when Amazon is having a Deal of the Day.

The excuses stop here. 💅

Open a Dedicated Savings Account

So now that you’re putting money aside each check, where do you store that cash? In a high-yield savings account, of course!

I say it like 15 times a day, but compound interest is our friend! Let your money work for you in a HYSA. The $$$ you put aside each check will earn a little interest to make Christmas even merrier.

Plus, this will help you resist the temptation of dipping into your Christmas fund for other purposes. Out of sight, out of mind until you need them!

When considering where to open your HYSA, I like to think about two things:

A good interest rate (usually anything 4% or better)

How easy it is to manage your money online

For these two reasons I like Ally. Ally even has a special “bucket” feature so you can keep your savings goals separate. Just set up a bucket for Christmas and allocate your bi-monthly deposits into that bucket so you know exactly how much you’ve saved for the holidays!

Automate Monthly Transfers

Once you have your HYSA setup for holiday spending, automate transfers into that account. This way your money is being put aside each pay period without having to have all of that emotional trauma of prying it out of your hands.

Again, out of sight, out of mind!

Utilize Rewards and Cash Back Programs

I love Rakuten because it’s literally giving you free money for the things you’d purchase anyway.

Emphasis on purchase anyway. If you can get 5% cash back for the sweater you were going to buy your aunt for Christmas, that’s a win! If you’re dipping into your Christmas fund because you have a 5% cash back offer at Lulu and you just want the new season’s leggings? Stop it.

Take advantage of programs like Rakuten. Fetch Rewards, Dosh and more. Also, if you’re particularly good with credit cards (and literally only if you’re good with them because otherwise you’ll be damaging your credit score and paying more in interest than you’ll be earning), consider opening a rewards card like the Chase Sapphire Preferred card to earn cash back and travel credits!

I’ve rounded up these resources and more money saving goodness on this page on my site. Be sure to check them out!

Avoid Last-Minute Panic

By planning for Christmas now, we’re establishing a really good game plan and sticking to it.

But sometimes the spirit of the season can be really alluring. Don’t give in to the temptation for last-minute shopping. This just leads to impulse purchases and regret.

Make a really detailed plan for who you’ll be shopping for and what you plan to buy now so that you aren’t tempted to overspend on last minute junk (and I do mean junk).

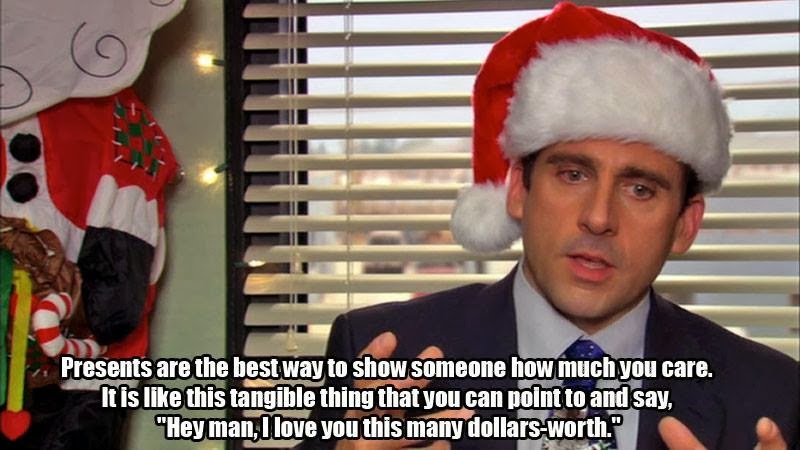

Give the Gift of Financial Freedom

Do not, I repeat DO NOT, go into debt or squander your savings trying to show your family and friends how much you love them.

Some people’s love language is giving gifts. Some people prefer experiences over gifts. Some people love DIY gifts. Whatever makes you happy is what you should do.

But trust me when I say, your friends and family do not want you to go into debt for the holidays.

Spend until your heart's content, but make sure you’re not overdoing it. You know how much you can afford and you know how much you’ve set aside for Christmas. Set those boundaries now!

There truly is no greater joy than financial freedom! Give yourself and the ones you love the gift of the peace of mind that comes with being debt-free!

Wrapping Up

If you’ve been meaning to get your budget under control and want to reduce your stress this holiday season, get my BRAND NEW BUDGET TRACKER!

It’s totally free and it’s the perfect opportunity for you to see what you have to work with now instead of later. Happy planning!